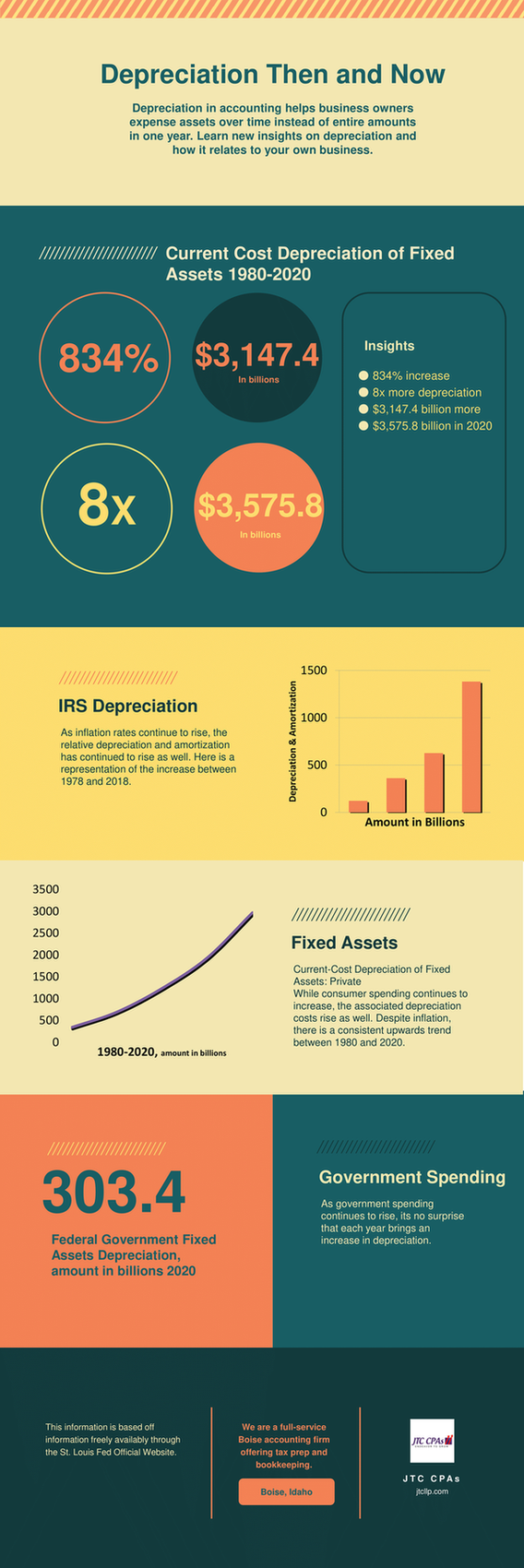

How Depreciation has changed over a 40 year span between 1980 and 2020. There are several interesting factors that have significance and what they can mean for your small business. Make sure to pay attention if things are increasing too rapidly. Discuss with your small business accountant in Orlando for specialized help in your specific […]