Calculating straight-line depreciation within a small business is a standard accounting procedure at your small business accounting firm in Orlando. Expensing assets in terms of depreciation are important to prepare for year-end tax preparation. Given the value of certain assets, it can be beneficial to spread out the depreciation over the useful life of the assets.

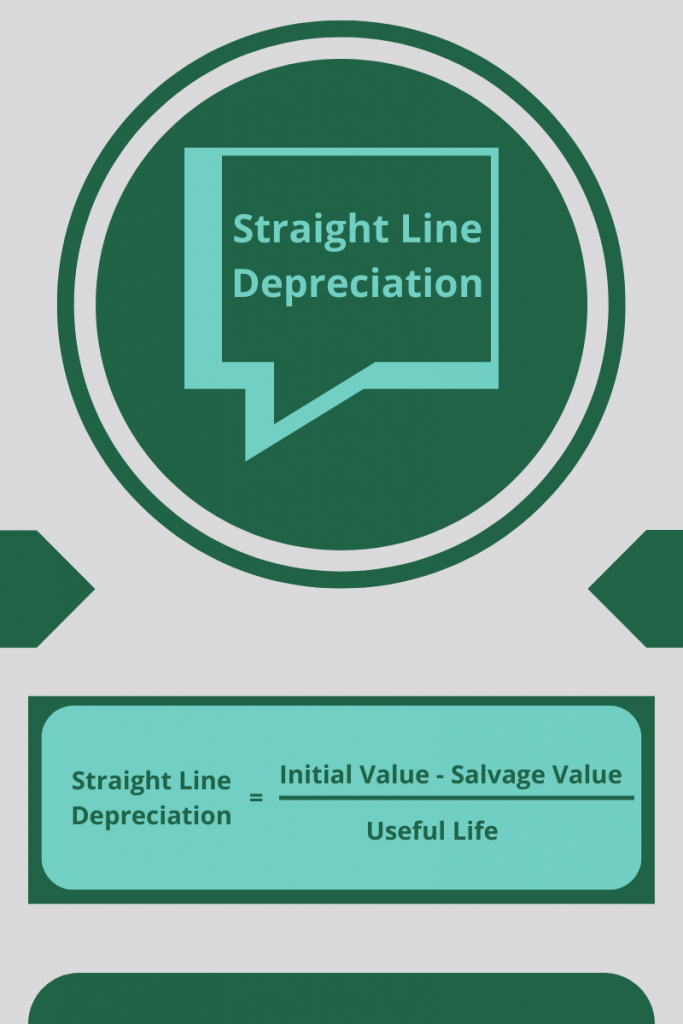

Formula

Physical assets are more easily represented in straight-line depreciation due to their tangible nature. Business assets such as cars, trucks, and real estate are subject to depreciation at various rates. While not always fully representative of the true depreciation in each scenario, straight-line depreciation can help provide a general picture of the value of assets. Calculating the depreciation of these assets in the straight line method by your small business accounting firm in Orlando is a relatively simple process. First, you must take the difference between the original asset value and its salvage value. Then, you divide the difference by the useful life of the asset in years.

Example

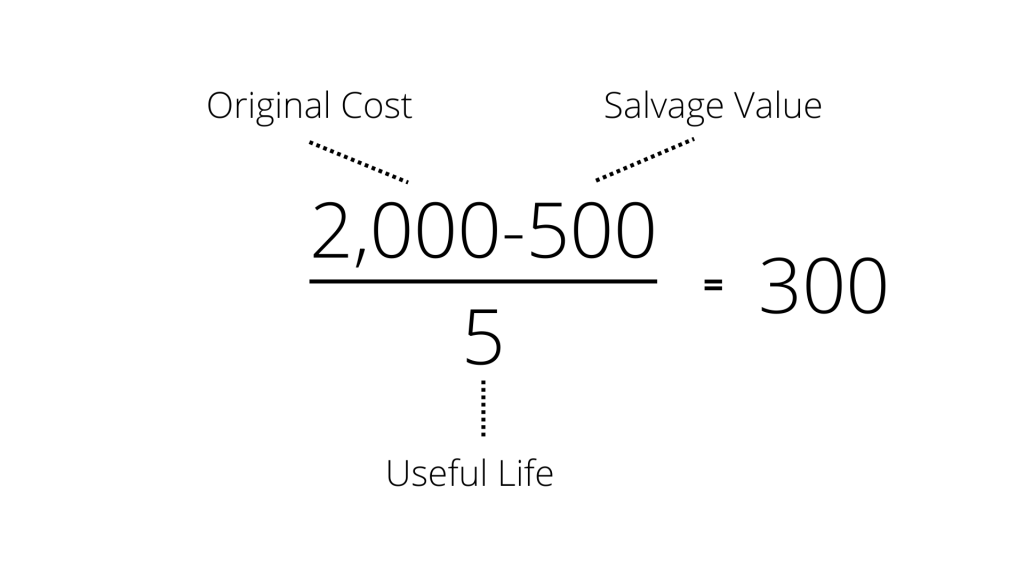

For example, your business could buy a $2,000 piece of equipment with a salvage value of $500, and the useful life is 10 years. Calculating the depreciation expense using the straight-line formula would look like this:

Accounting

In a small business, you want to make sure these accounting values are spot-on. Errors can cause delays, penalties, or missed deductions from tax filings. Be sure to provide all relevant information that pertains to your business operation. Your small business accounting firm in Orlando works hard to ensure the accuracy of depreciation and all other relevant accounting numbers.

Wrap Up

When you have new assets purchased for your small business, make sure to notify your small business accounting firm in Orlando of any changes. Depreciation can only be factored in correctly when your accountant is aware of your most up-to-date situation.