From the backlog built up during the Covid-19 pandemic, the IRS was simply unable to keep up with processing new paper information returns. There were several factors that led up to this point, including the lack of upgrades and improve processes utilizing modern technology already available commercially. Regardless of the situation, these circumstances were unavoidable and an example of the lack of oversight within federal government programs.

Treasury Inspector General for Tax Administration

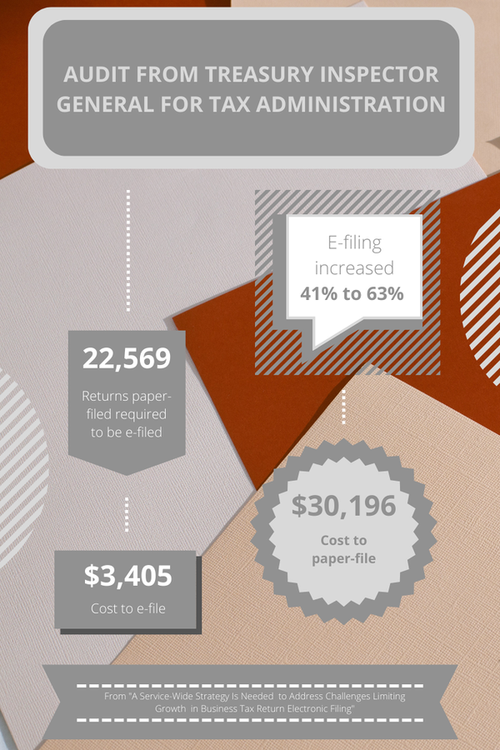

The audit of the IRS was conducted by the Treasury Inspector General for Tax Administration (TIGTA). During the course of the audit, it was reported that the “IRS does not have a service-wide strategy… for e-filing”. There were further issues with the IRS’ failure to “establish processes… to identify… corporate… filers that do not comply with e-file mandates.” Recommendations were made by TIGTA to establish a strategy for e-filing, efficiently “identify and address potentially noncompliant corporate filers” and ensure consistency with penalties against “filers that are noncompliant”.

Lack of Oversight

The decision to destroy 30 million paper information returns is a further example of the lack of oversight from other agencies to the IRS. There should be increased transparency, especially when it comes to the handling of sensitive tax filer information. A first step would be to heed the recommendations made by TIGTA and continue to enforce these new procedures over the coming years.

Double Standard

There appears to be a double standard when it comes to taxes. Somehow, it seems OK for the federal government to destroy documents submitted by taxpayers and ignore our letters. On the other hand, they demand immediate response when they send us letters. This is unfair to law-abiding taxpayers and business owners who are doing their best to comply with rapidly changing policies while still getting slammed with tax penalties.

What We Recommend

As your small business accountant in Orlando, we are looking out for updates to the tax code and any implications that apply to your business. Your small business may qualify for deductions and we want to make sure that you receive any and all deductions in a timely manner. When you speak with us, you can trust that we will research your business on an ongoing basis to ensure compliance with federal and state regulations.